IRA Updates on Part D

The Inflation Reduction Act (IRA), passed in 2022, includes major changes to Medicare Part D intended to control prescription costs, cap maximum retiree out-of-pocket costs and simplify coverage for Medicare enrollees. This strengthening of Part D offers improved coverage for retirees as well as new risks and opportunities for employers who sponsor group Medicare Part D plans.

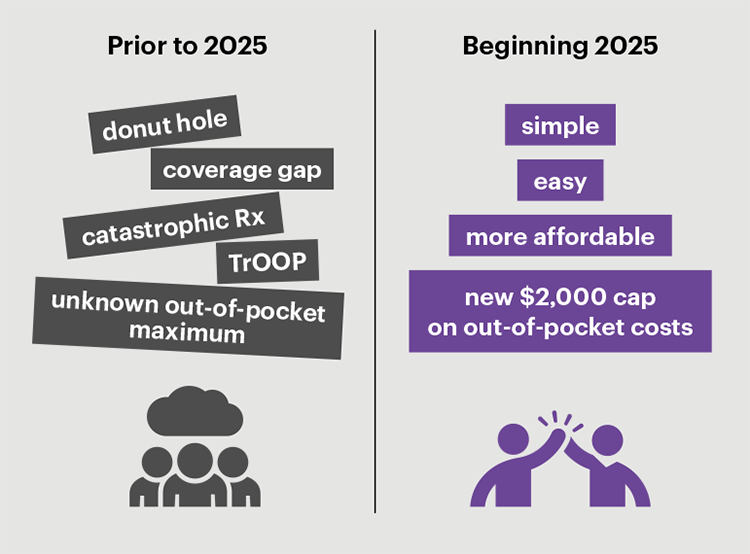

Prior to 2025, Part D had lots of complexities, including the coverage gap (or “donut hole”), the true out of of pocket (TrOOP) maximum, and the 5% catastrophic coinsurance (eliminated for 2024). Under the IRA, Part D will be dramatically simplified for Medicare recipients beginning in 2025

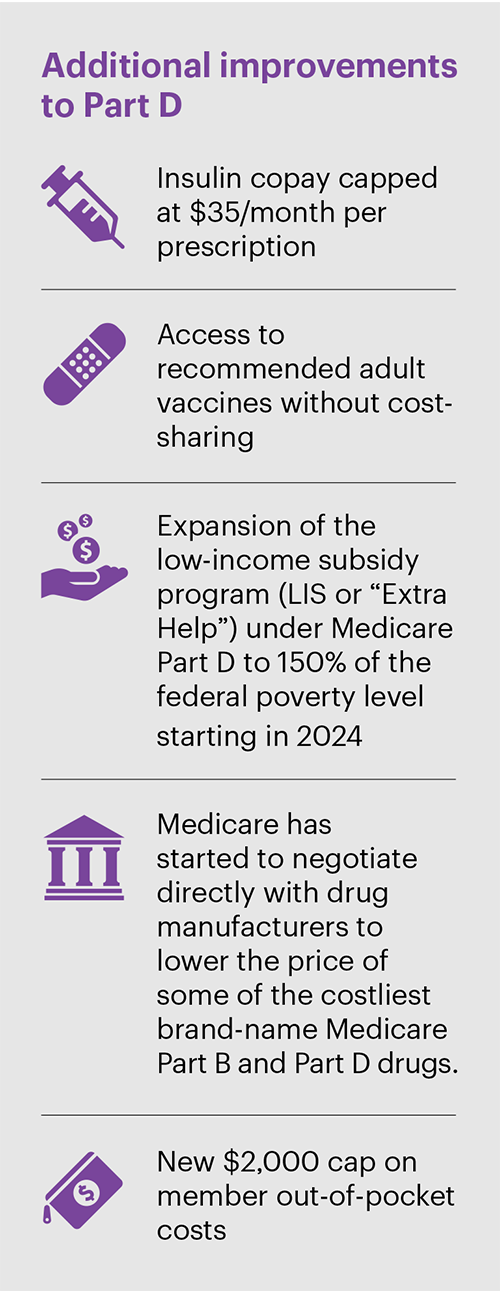

The current Part D benefit contains a range of complex program terms, which confuses retirees and leaves them without a clear understanding of their maximum out-of-pocket cost liability. With the IRA comes a new (in 2025) Part D benefit approach that eliminates the prior complexities by adopting a much simpler structure plus a $2,000 cap on an enrollee’s annual out-ofpocket costs. In addition, for the first time, the federal government is capping prescription drug cost inflation and negotiating drug prices with the pharmaceutical makers. These changes go far to realize the vision of Part D as a comprehensive and fully adequate source of Medicare prescription drug coverage.

The new Part D program eliminates provisions such as the coverage gap (the “donut hole”) and the “true out of pocket” (TrOOP) maximum. Also eliminated (in 2024) is the 5% cost share paid by enrollees after their annual spending has reached the TrOOP maximum. Starting in 2025, Part D plans may have a deductible and then cost sharing will apply until the member has reached $2,000 in out-of-pocket costs, after which the plan will pay 100% of the cost for the remainder of the year. It’s as simple as that.

While these changes are highly beneficial to enrollees, there may be financial risks to employers sponsoring group Medicare Part D plans (a.k.a. Employer Group Waiver Plans or EGWPs)

How does the IRA impact Part D plan sponsors?

While Part D is becoming far more attractive to Medicare seniors, the changes under the IRA may not be beneficial for EGWP sponsors. This is because the IRA is mandating substantial benefit enhancements and changing how it pays Part D plans in a way that could be adverse to EGWP sponsors. Under Part D, EGWP sponsors receive funding from various sources to offset the cost of the group plan. The government provides these funding sources to EGWP sponsors as an inducement to retain group post-65 prescription drug coverage. Changes in 2025 to the formulas for determining these funding sources (e.g., direct subsidies, pharmaceutical discounts and federal reinsurance) could reduce the total level of these third party payments to an EGWP sponsor, thus increasing their net plan cost. This presents plan sponsors with some unpleasant choices:

1. Absorb the cost increase, making retirees happy, but their finance department unhappy.

2. Pass the cost increase onto retirees in the form of contribution increases or benefit cuts, leading to a happy finance department, but less-than-happy retirees.

To avoid these unpleasant options, employers can cease group plan sponsorship and instead direct retirees to obtain individual Medicare Part D coverage (and medical coverage) through a marketplace exchange, with employer funding through a Health Reimbursement Arrangement (HRA). With this approach, retirees gain all the benefits of the new Part D program while employers enjoy a reduction in their administrative effort and potentially in their coverage costs. Many employers have done exactly this over the years as individual market insurance coverage has become more attractive compared to group plan coverage. These IRA-driven enhancements to Part D in 2025 may lead some employers to consider (or reconsider) a shift to the individual market for their retirees.

Employers sponsoring EGWPs are advised to assess the possible financial impact of the IRA on their group Part D plans. Via Benefits offers employers a Financial Impact Assessment, including modeling of the IRA impact on their EGWP, to help plan sponsors make the best decision for the organization and its retirees.

Request Part D EGWP Financial Assessment: